The Ethereum (ETH) to Bitcoin (BTC) price dynamic is more than a simple trading pair—it’s a window into the evolving priorities and behaviors of the cryptocurrency market. By tracking this ratio, investors gain valuable insights into market sentiment, technological adoption, and capital rotation within crypto ecosystems. As Ethereum continues to innovate with upgrades and decentralized applications, and Bitcoin maintains its dominance as a digital store of value, shifts in the ETH/BTC ratio serve as early indicators of broader trends. Understanding this interplay is essential for traders, developers, and enthusiasts looking to anticipate market moves and position themselves accordingly.

Ethereum (ETH) to Bitcoin (BTC) Price Dynamics: A Deep Dive into Crypto Market Trends

Why This Topic is Important Now

Cryptocurrency markets are constantly evolving, but few relationships within this ecosystem are as closely watched as the one between Ethereum (ETH) and Bitcoin (BTC). As the two largest cryptocurrencies by market capitalization, ETH and BTC don’t just lead the market—they shape it. Yet, beyond tracking their price in USD, there’s an even more insightful metric: the ETH/BTC price ratio.

This ratio reveals how Ethereum performs relative to Bitcoin, acting as a barometer for broader trends such as investor risk appetite, technological progress, and the ongoing battle between digital utility and digital gold. As the market transitions between bull and bear phases, the ETH/BTC chart often provides clearer signals than fiat-based valuations.

In this article, we’ll explore:

- The historical and technical dynamics of ETH/BTC

- The fundamental factors that influence this relationship

- Why this ratio matters for investors and the broader market

- Key developments that could shift the ratio in the near future

A Primer: What is ETH/BTC?

ETH/BTC is a trading pair that expresses the price of one Ethereum in terms of Bitcoin. For example, if the ETH/BTC ratio is 0.07, it means one ETH equals 0.07 BTC. This pair allows traders to evaluate Ethereum’s strength relative to Bitcoin, removing USD or other fiat currencies from the equation.

This ratio is commonly used to:

- Assess capital flows between major crypto assets

- Gauge market risk tolerance (ETH usually outperforms BTC in bullish periods)

- Predict altcoin seasons or phases of Bitcoin dominance

It’s not just a chart—it’s a compass for navigating the crypto economy.

Historical Performance of ETH/BTC

2017: The ICO Boom

Ethereum gained massive traction as the go-to platform for launching Initial Coin Offerings (ICOs). This drove huge demand for ETH, sending the ETH/BTC ratio to an all-time high of ~0.15. During this period, Ethereum’s narrative as the “new internet” took hold, and capital rapidly flowed in.

2018: Bear Market Blues

As the ICO bubble burst, ETH suffered disproportionately. Bitcoin, being seen as more stable, regained dominance. ETH/BTC fell to lows around 0.02. Investors rotated capital back into Bitcoin or exited crypto entirely.

2020–2021: DeFi & NFT Revolution

Ethereum surged back with the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs). Total Value Locked (TVL) in Ethereum-based protocols exploded, and ETH/BTC climbed again to around 0.08. Investors viewed ETH as a growth asset with utility.

2022 Onward: The Merge and Market Uncertainty

Ethereum’s transition from Proof of Work to Proof of Stake via “The Merge” was a historic upgrade. While technically successful, it didn’t immediately translate into price outperformance. ETH/BTC hovered between 0.06–0.07, reflecting mixed investor sentiment amid global macroeconomic uncertainty.

Technical Analysis: Chart Patterns & Key Levels

Traders closely monitor ETH/BTC charts for support and resistance levels. Some significant ones include:

- Support Levels: 0.05 and 0.055 – Historically, buyers have stepped in at these points.

- Resistance Levels: 0.08 – This has proven to be a tough level to break and maintain.

- Trend Signals: A breakout above 0.08 often signals altcoin strength, while a drop below 0.05 could indicate market-wide caution or a return to Bitcoin dominance.

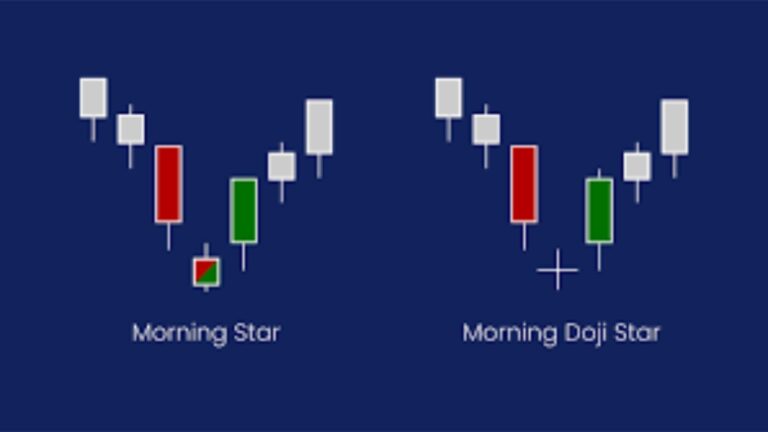

Momentum oscillators like RSI and MACD on weekly ETH/BTC charts also help predict directional shifts. Generally, ETH/BTC performs well in bull markets and underperforms in high-volatility or risk-off periods.

Fundamental Drivers of ETH/BTC Dynamics

1. Technological Innovation

Ethereum is constantly evolving. The shift to Proof of Stake (PoS), introduction of Layer 2 scaling solutions (Arbitrum, Optimism), and the upcoming roadmap including sharding and stateless clients aim to make Ethereum more scalable and cost-efficient.

Bitcoin, by contrast, is intentionally slow-moving and conservative. Its value lies in security, scarcity, and decentralization. While Ethereum pursues utility, Bitcoin focuses on trustlessness and monetary policy.

This divergence means that Ethereum may outperform during periods of innovation hype, while Bitcoin regains strength during uncertainty.

2. Network Usage & Activity

Metrics like transaction volume, gas usage, smart contract deployments, and TVL in DeFi heavily impact ETH valuation. If Ethereum is the dominant layer for dApps, it justifies a higher ETH/BTC.

In contrast, Bitcoin’s use is more static—primarily as a store of value or transactional currency. It doesn’t benefit as directly from blockchain adoption spikes as Ethereum does.

3. Institutional Adoption

Bitcoin has become the entry point for institutions due to its digital gold narrative. Companies like MicroStrategy and Tesla have BTC on their balance sheets.

Ethereum is catching up. The possibility of a U.S.-approved spot ETH ETF could drive institutional demand, potentially boosting the ETH/BTC ratio. However, regulatory clarity is still evolving.

4. Tokenomics & Supply

With Ethereum’s EIP-1559 fee burn mechanism and staking rewards, ETH has the potential to become deflationary—especially in high activity periods. This contrasts with Bitcoin’s fixed supply and halving cycles.

As ETH supply tightens, especially with more ETH locked in staking, its scarcity could increase relative to BTC.

Macro Factors: ETH/BTC as a Market Sentiment Gauge

The ETH/BTC ratio also mirrors macroeconomic trends:

- Risk-On Environments: Low interest rates, high liquidity, and bullish sentiment often favor ETH over BTC, as investors seek higher upside.

- Risk-Off Environments: During market uncertainty (e.g., rate hikes, global crises), investors tend to rotate into Bitcoin for safety or exit to fiat, pushing ETH/BTC down.

Additionally, the Bitcoin Dominance Index is an important tool. A rising dominance suggests BTC is outperforming altcoins; falling dominance often correlates with ETH/BTC rising.

What Could Move the ETH/BTC Needle Next?

1. Spot ETH ETF Approval

Approval of an Ethereum ETF in major markets could unlock billions in institutional capital. ETH/BTC would likely surge, especially if this leads to broader recognition of Ethereum’s utility layer.

2. Successful Rollout of Ethereum 2.0 Upgrades

As Ethereum continues scaling via Layer 2s and introduces features like danksharding, its network could become more efficient and widely adopted. This might lead to a sustained ETH rally against BTC.

3. Bitcoin Halving (April 2026)

Historically, BTC sees strong rallies after halving events. Depending on timing and market conditions, ETH could either follow or lag—impacting the ETH/BTC ratio accordingly.

4. Real-World Asset (RWA) Tokenization

Ethereum is leading efforts to bring real-world assets (like bonds, real estate) on-chain. If this sector booms, Ethereum’s economic activity and valuation could rise sharply relative to Bitcoin.

Investor Implications: Why You Should Care

For retail and institutional investors alike, the ETH/BTC ratio is not just a trade—it’s a strategic tool:

- Portfolio Allocation: Rotating between ETH and BTC based on ratio trends can improve returns or reduce risk.

- Market Cycle Timing: ETH/BTC breakouts often precede altcoin rallies; downturns may hint at a wider market correction.

- Understanding Sentiment: A rising ratio indicates risk-taking and optimism; a falling one suggests defensiveness.

By watching this ratio, investors can make more informed decisions, even if they never trade the pair directly.

Final Thoughts

The ETH/BTC ratio is one of the most powerful indicators in crypto—not just for traders, but for anyone trying to understand the market’s heartbeat. It reflects the ongoing tension between innovation and stability, utility and store of value, growth and preservation.

As Ethereum evolves and Bitcoin maintains its foundational role, the balance between the two will continue to shift. Smart investors will be watching closely—not just the USD charts, but the ETH/BTC pair—to stay ahead of the next big move in crypto.