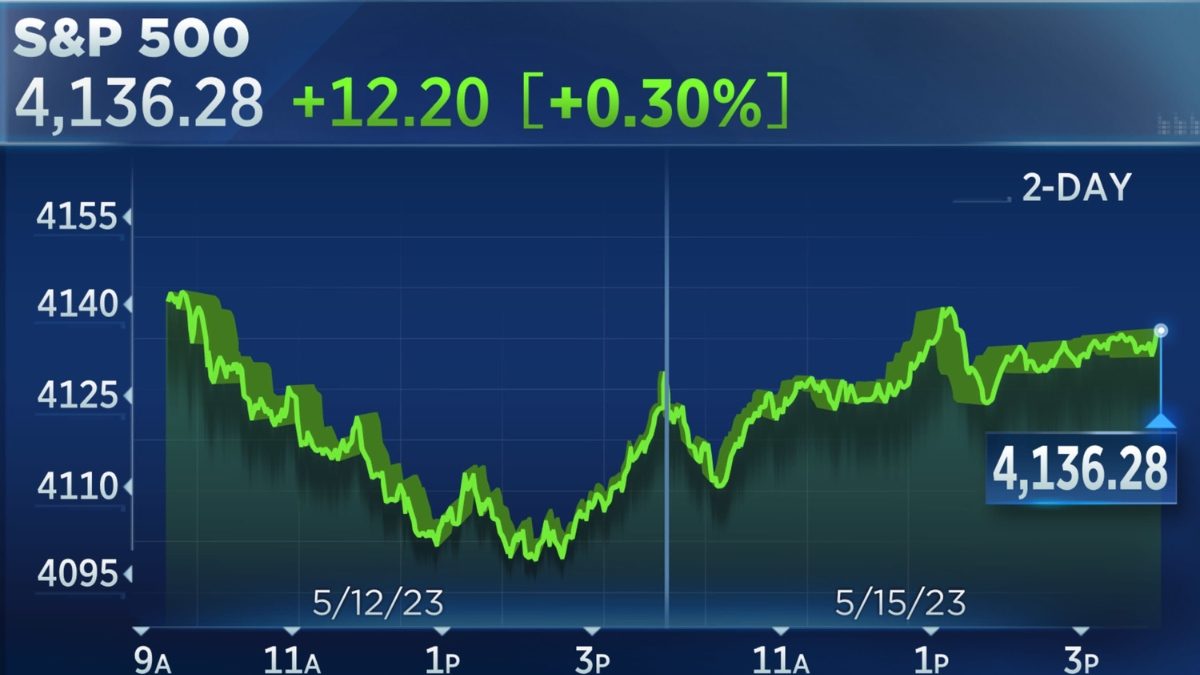

Today’s S&P 500 market had a mixed day during the day as Wall Street struggled to find an axis that was clear, with the S&P 500 hovering near record heights as investors absorbed announcements of corporate deals as well as specific sectoral movements. In contrast to a dramatic rally markets, they showed hesitation in the market as investors balanced optimism cautiousness.

The main indexes began the session on a slow note and a sense of uncertainty, despite recent positive gains.

Mixed Session Across Major Indexes

The S&P 500 was able to hold its previous highs, but did not move significantly higher. The gains in certain sectors were offset by weaker performance in other sectors, leading to an essentially flat session.

The Dow Jones Industrial Average moved only slightly as investors demonstrated a the desire to invest in companies that have been around for a while. While the Nasdaq saw moderate volatility that reflected a varied performance for the technology sector.

The mixed trend suggests the S&P 500 market is currently slowing down rather than increasing.

Corporate Deal News Influences Trading

Corporate announcements played a crucial influence on market movements. Certain S&P 500 stock markets reacted strongly on news about deals, creating fluctuations in specific industries.

A notable player was Mobileye who experienced extreme price volatility following the release of reports relating to developments in the strategic realm. These moves show how the impact of individual market news can continue to influence the market’s behavior in the short term regardless of whether broader market indexes stay stable.

Technology Stocks Show Uneven Strength

Tech shares had mixed performances throughout the course. While tech stocks that are large in size continued to support the Nasdaq however, other tech stocks were subject to the pressure of selling as investors looked at the value of their investments.

This varying performance reflects the general trend that investors tend to be more focused. Instead of buying broadly money is being directed towards businesses with higher growth potential as well as stronger foundations.

In the end, technology stocks have a place but do not longer can guarantee an upward trend for today’s stock market.

Investor Sentiment Remains Cautious

Although markets trade near their the highs of their previous, investors’ sentiment is to be tempered. Instead of chasing the gains, investors wait for confirmation from economic data and the signals from policy makers.

The cautious approach suggests investors are mindful of possible dangers, such as declining growth indicators, as well as uncertainties regarding the direction of interest rates. This is why many prefer to safeguard the gains instead of extending their exposure.

Economic and Policy Factors in Focus

- Markets continue to be a monitor of wider economy conditions.

- The trends in inflation, data on employment and commentary from central banks are essential to investors’ decision-making.

- Unexpected data can quickly change the direction of market.

- As long as no clearer indicators appear, the markets will likely to continue moving in a downward direction as investors try to are able to balance their optimism and risk-awareness.

Sector Rotation Shapes Market Action

The sector’s rotation is evident and money flows in and out of various sectors. Value-oriented and defensive stocks were a source of interest but growth-oriented stocks faced tension.

This indicates that investors are changing their portfolios, rather than leaving the market completely. This is often the case when the indexes are trading near their levels without triggering.

What to Watch Next

- For the foreseeable future trading will pay close attention to the upcoming reports on earnings and macroeconomic announcements.

- This could decide if the S&P 500 rebounds or enters a longer consolidation phase.

- Deal activity as well as corporate direction will continue to be key elements of stock performance.

Conclusion

Today’s market is a reflection of more of a balance than a conviction. The S&P 500 in the vicinity of its highest levels and the news about corporate developments leading to a range of fluctuations, markets may slow down following recent gains.

Although the general trend is relatively stable, traders are wary, waiting for better signals before making the next step. In the meantime trading sessions are mixed and a selective approach to trading will likely to determine the near-term behavior of markets.